From Scams to Breaches, the Risks are Increasing

Identity threats are rising, from phishing and mobile scams to data breaches and offline fraud. Attacks are growing faster and more sophisticated, striking before victims realize. Consumers expect stronger protection and are turning to their financial institutions for help.

$12.5 billion

lost to fraud in 2024 by U.S consumers

6.5 million

Fraud and identity reports filed in 2024

100+ hours

Spent by victims resolving ID theft & fraud

Give Your Customers the Protection They Need

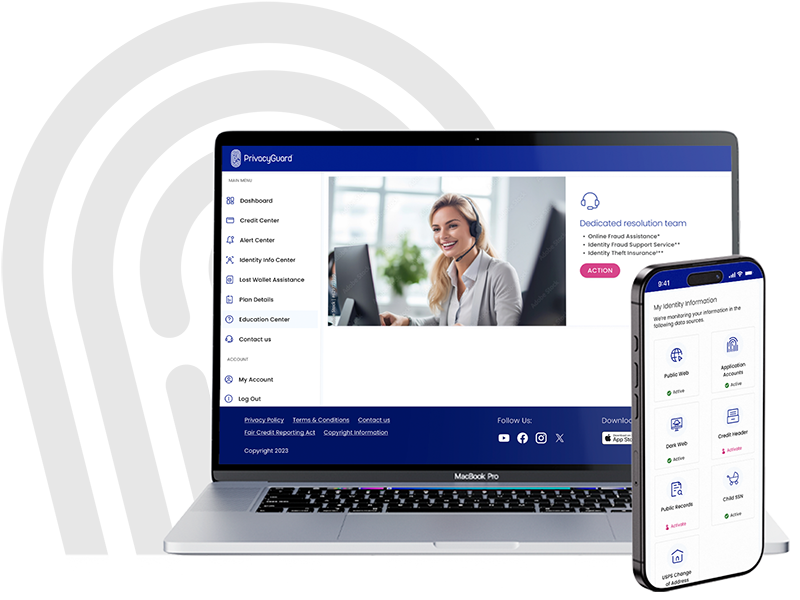

PrivacyGuard is a fully configurable Identity Protection solution that can be tailored to your brand, customer segments, or business needs. From product structure to pricing and messaging, PrivacyGuard offers the flexibility to meet your goals without adding complexity for your team.

You decide how to deploy it:

Add to an

Existing Benefit Package

Enhance your existing program by embedding ID protection benefits into a broader customer benefits or loyalty package, increasing perceived value and stickiness.

Introduce a

Premium Tier

Offer Identity protection benefits as a standalone upgrade or paid tier, giving customers more protection while generating predictable, non-interest income.

Launch a

White-Label Offering

Launch PrivacyGuard under your own brand, fully integrated into your customer journey, delivered end to end by PrivacyGuard.

Comprehensive Protection Where It Matters Most

PrivacyGuard identity protection benefits cover four key areas – Education, Prevention, Detection, and Resolution. The solution is fully configurable, so you can select only the benefits that support your strategy while meeting your customers’ needs.

Click here to see a full list of PrivacyGuard’s Identity Protection and Credit Monitoring benefits

PrivacyGuard®

Total Protection

Credit AND Identity Protection benefits in one

What We’ll Watch

- Monthly Triple-Bureau Credit Score Tracking

- 24/7 Triple-Bureau Daily Credit Monitoring

- Public & Dark Web Scanning

- Social Security Number Monitoring

- Driver’s License & Passport Monitoring

- Debit & Credit Card Monitoring

- USPS Address Change Verification

- Email, Phone, Name, DOB Monitoring

- ID/Application Verification Monitoring

- Public Records Monitoring

- Children’s Social Security Number Monitoring

What customers get

- Email & Text Alerts

- Monthly Status by Email & Text

- Dedicated ID Fraud Resolution Agent

- Monthly Triple-Bureau Credit Reports & Scores

- Credit Score Simulator

- Credit Information Hotline

- Financial Calculator Suite

- Online Fraud Assistance

- $1 Million ID Theft Insurance

- Lost & Stolen Wallet Protection

- Annual Public Records Report

- Reduced Pre-Approved Credit Card Offers

- Neighborhood Reports

- Registered Offender Locator

- Emergency Travel Assistance

- Medical Records Reimbursement

Education

Actionable content to raise awareness and reduce risk.

PrivacyGuard offers tools and resources that help your customers recognize threats and take smart, preventative action, strengthening their trust in your brand.

Benefits include:

- Proactive fraud education and identity risk guidance

- Digital safety tips integrated into customer communications

- Ongoing updates and alerts about emerging threats

Prevention

Reduce the risk of identity theft before it happens.

Our prevention tools protect sensitive personal and financial information by reducing exposure to common attack points.

Benefits include:

- Safe Browsing tools and malware detection

- Mobile Security Checks and anti-virus tools

- Application monitoring to flag risky behavior

Detection

Catch threats early, when they’re easiest to stop.

PrivacyGuard’s detection services provide ongoing monitoring and real-time alerts across a customer’s identity footprint.

Benefits include:

- 24/7 credit, identity, and dark web monitoring

- Instant digital alerts via mobile app, email, or SMS

- Push notifications when suspicious activity is found

Resolution

Expert help when it’s needed most.

Recovery is critical when fraud occurs. PrivacyGuard provides customers with direct access to FCRA-certified specialists who guide them through the resolution process with empathy, efficiency, and authority.

Benefits include:

- 24/7 personalized support and case management

- Help with credit disputes, lost card replacement, and account security

- Up to $1,000,000 in identity theft insurance (terms apply)